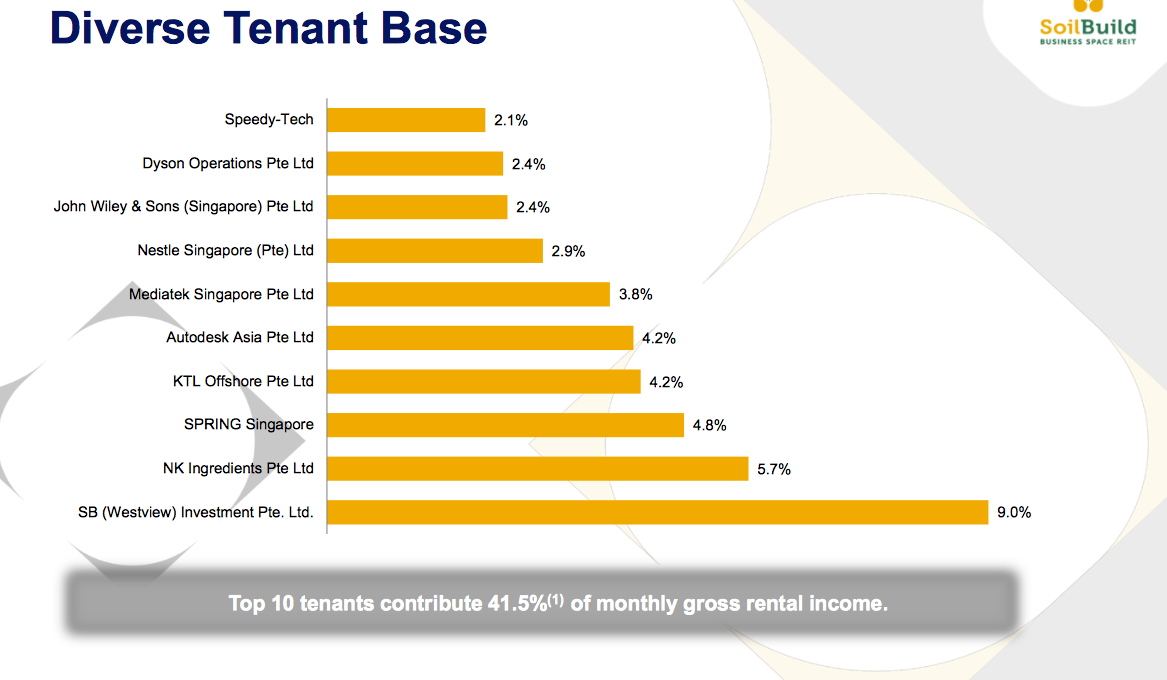

Things are not looking good for Soilbuild Business Space REIT (SV3U:SI). Despite having one of the highest dividend yields among the S-REITs, Soilbuild Business Space REIT has been hit with another possible rental default from KTL Offshore (reported by The Edge Singapore). Based on its results presentation for 3Q 2017, KTL Offshore is Soilbuild’s third-largest tenant, contributing 4.2% of the REIT’s monthly gross rental.

To recap, last year when Singapore’s oil and gas industry was hit by low oil prices, Technics Oil & Gas which was Soilbuild’s largest tenant (11.1% based on its 2015 Annual Report), defaulted on its rental. 72 Loyang Way which it previously occupied is still untenanted. Then again in September this year, NK Ingredients which was the largest tenant, contributing 5.7% of the REIT’s monthly gross rental defaulted on its rental too.

Disclaimer: All analyses, recommendations and other information herein are published for general information. Readers should not rely solely on the information published and should seek independent financial advice prior to making any investment decision. The publisher accepts no liability for any loss whatsoever arising from any use of the information published herein.